Trust Issues

Hi Folks! 👋

Happy Sunday! I am having a great weekend so far - went for a long bike ride Friday, saw my friend (and coach) for a good game of tennis yesterday and then went out with the girls.

As we were sipping on some Rosé, one of my girlfriends mentioned that another girlfriend of hers was in a relationship with this guy and they both really loved each other but the guy would occasionally cheat on her. (Modern Love, perhaps?) When the girl found out about it, she naturally confronted him. The guy denied at first but later admitted and said that whenever he would get stressed, he would (s)ext these random girls for hook up, but that didn’t mean anything and she is the love of his life. (Umm…WTF?) Apparently, there were multiple girls on his stress-induced-sexting roster but he claims that he is past this ‘stupidity’. (Yes, he thinks ‘stupid’ is the only correct word to describe his chronic infidelity.) And yes, he also doesn’t believe he needs any therapy. But here is a bigger twist. He apologized to her and assured her that he will be a better man going forward but when she didn’t buy it, he got super upset at the girl for overreacting and lambasting him. And now he’s mad at her as if she did him wrong! OMG!!! I don’t know this guy but he reminds me of the John Meehan character from Dirty John. A classic manipulator. It was a hard show to watch because you think that this can’t be true in real life but apparently it does happen.

I sincerely hope that Dirty John seeks some help, and the girl recovers from this toxic relationship because as Esther Perel has wisely said, ‘the quality of our relationships determine the quality of our lives’. But the story definitely shook me a bit and I woke up thinking about it this morning…especially about the role of ‘trust’, and what happens when it’s breached. But since I am not a relationship expert like Esther Perel and this is not a relationship blog, I am more interested in understanding what happens when asset classes ebb and flow through the cycles of trust, as lack of trust seems to have eroded short term alpha from the SPAC market. (You see my twist there 😉)

$SPAK, the SPAC ETF posted a negative return of 11% for July, and is down 33% from its peak in February.

Despite accounting for 68% of the equity issuance in 2021 so far, majority of the new SPAC IPO’s are trading below par with a median price of $9.72. Most of the new deals announced are trading below par. Most of the deals post merger vote are trading below par. Why is that, you ask? A lot of it can be attributed to lack of trust in SPACs right now. And it is further exacerbated when you hear of stories like Trevor Milton (the $NKLA guy) defrauding investors and lying about ‘nearly all aspects of the business.’

The weakness is persistent even in the good quality names post merger. It’s almost as if the market needs to see a couple quarters of consistent performance, earnings to be beaten and guidance to be reaffirmed and raised, lockup expirations and redemptions to be over before the investors will ‘trust’ again. Adding to the skepticism is the increasing intervention by the SEC.

While Gary Gensler entering the chat is negative from a trading perspective in the short term, it is a net positive as more regulation will help in reinstating the trust in the asset class in the longer term. It has already led to the speculators exiting the chat as there are no more deal pop tendies available. However, I feel it has also created an opportunity to get in on quality names at ~NAV prices post merger. Repairing of trust is a function of time, and therefore, if you are willing to change your strategy and exercise some patience, there are some good potential names on the table. As I have written previously, $MTTR, $SOFI, and $MAPS remain my top three names as beneficiaries of the trust bounce-back. They may be a bit volatile in the short run, and take some time to build credibility on a standalone basis and get rid of the negative connotation around their path to go public via a SPAC, but all those short term dips are buying opportunities in my opinion.

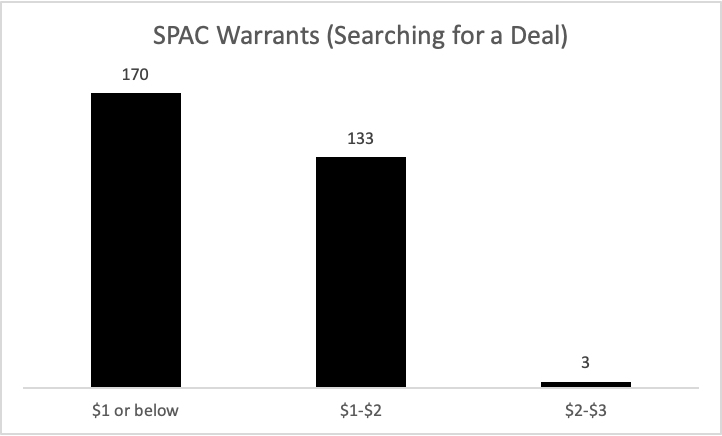

From a more short term trading perspective, there does remain an opportunity in the SPAC warrants space. Out of the 306 SPACs (that offer warrants) currently searching for a deal, there are 170 trading at $1 or below. There are 133 that are between $1-$2, and 3 between $2-$3.

I haven’t dabbled too much in warrants myself, except for grabbing $ATVCW, $LUXAW, and $HERAW when they traded closer to ~$1. But for the swingers out there, there is definitely an opportunity here. Especially for the warrants in the sub $1 range as a lot of them are trading at or close to their All Time Lows.

Allocating majority of the SPAC portfolio to some key names post merger with a longer term horizon while maintaining a minor portion to participate in the short term warrant action seems to be a prudent optimal mix. Any questions, hit me up. SPACs only, I mean! Re relationships - be nice, be kind and be loving!

Have a great week ahead!

Nikita