Hi Everyone 👋

Wow, what a weird week.

Bill Ackman is a really smart guy but he has this uncanny ability to take something rather simple and make it hopelessly complex. I think it’s his ego that wants him to “Ackmanize” everything. Strange. Speaking of strange, you know what else is strange? His hair. He’s one of the only guys whose salt-and-pepper noggin doesn’t make him look hot. Like how is that even possible?! Anyways, it’s mostly silver now… but still!

I think you have probably guessed by now that I wasn’t one of the $PSTH HODLers. But not for his non-Clooney looks. I honestly struggled with his mandate from the get go. He raised the $4B SPAC back in July 2020, and stated that he was going to find a ‘mature unicorn’. And he tried. There was lots of speculation early on that it would be with an Airbnb or a Stripe but I guess they were smart enough to realize that having Bill Ackman sit on their board would be an intense endeavour to say the least.

Ok, so with no mature unicorn willing/available to mate and almost a year gone by (out of the two that’s available to a SPAC to merge), Ackman’s Pershing Square Tontine Holdings was itself becoming a mature SPAC. The average SPAC has been announcing a deal in ~6 months and a longer time to find a deal is seen as a negative by the markets, and also potential targets. Which in his case, was already a narrow pool to begin with. So, he financially engineered a deal and ackmanized it.

But what’s the deal? The fact that I am on my fourth para and still haven’t been able to describe it should tell you about the obtuse nature of it, but let me try. Or you can read the full deal here. Basically there are 3 deals happening, and none of them are really SPACs. First, $PSTH will acquire 10% of the shares of Universal Music Group (UMG) for approximately $4B, which will give it an enterprise value of $35B. (Well technically they are still discussing.) It’s not really a SPAC merger because UMG is not a ‘mature unicorn’, and also, Vivendi (the parent company of UMG) had already announced that it was going to spin off Universal by the end of this year. But whatever. After funding the UMG transaction, $PSTH will still have $1.5B left, which will go to $PSTH Remainco (which will continue looking for another unicorn to merge with.) So as a $PSTH investor, once the UMG deal closes, you should receive UMG stock worth $14.75 and $PSTH Remainco stock worth $5.25. While $PSTH Remainco will continue trading on NYSE, it won’t be treated as a SPAC anymore. (We could all use one less SPAC…)

But that’s not all though! Ackmanization is a stupidly convoluted process. So the third part is that there is this new thing called SPARC - A Special Purpose Acquisition Rights Company. And as you can tell just by the name, it’s not a SPAC. With the SPARC, Ackman won’t raise any money until he finds an actual deal. But once he announces a deal, then through that SPAR, he will offer a right to $PSTH investors to acquire common stock in that new deal for $20 per share. The SPARs will trade on NYSE with a 5 year term, subject to extension. Essentially SPARs are the less formal version of SPACs, with no time limits on finding a deal, no shareholder votes, no warrants or cash value. Anyways, that is the Coles notes version of the Ackman deal. The market did not like it and $PSTH closed down 12%. But if you are interested in more detail, Matt Levine wrote an excellent piece describing this hot mess.

Moving on to some other interesting things in the SPAC land this week. There were 0 SPAC IPOs. Chamath filed 4 new S-1s. He’s trying to switch up the DNA of his business as all four of these new SPACs are $200M, biotech focused, no warrants, and will trade under the tickers $DNAA (neurology), $DNAB (oncology), $DNAC (organ space) and $DNAD (immunology). He ditched Hedosophia and picked up Suvretta as the new partner. He also ditched Credit Suisse and picked Morgan Stanley as their bookrunner. Kishen Mehta, who will serve as the President of these new SPACs, is the portfolio manager who runs the healthcare strategy (called Averill Strategy) at Suvretta. That means there are real health-y synergies here, especially given how specific each SPAC mandate is. Actually, I just realized that they’re almost taking an Ackman-esque type approach here. Except it’s probably easier to find a neurology focused company than a mature unicorn.

But more importantly, as I wrote last week, so far the SEC hasn’t laid down any strict rules on Sponsors not being able to merge with their own portfolio company. In fact, Reid Hoffman’s second SPAC $RTPY is apparently merging with Aurora, an autonomous vehicle company, and his firm Greylock Partners, co-led their $90M Series A round (with Index Ventures) in February 2018 and he is also board member of Aurora! But so far SEC has no problemo! So with SEC on the Sponsors side currently, combined with Suvretta’s deep healthcare focus, and the recent lambasting that Chamath’s ego has suffered, I am reading his mandate precision to be a positive indicator. Of course, we are still a few months away before it starts trading, but this is sounding good.

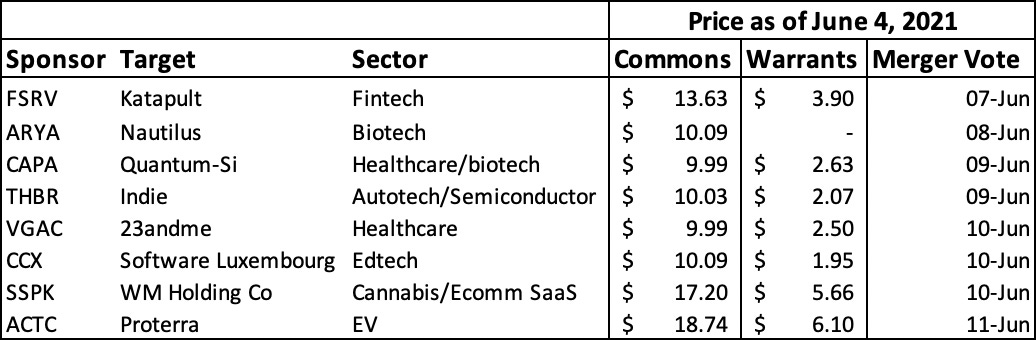

Next, it seems like everyone’s got the memo that SPAC pops are a thing of the past. Reflecting that is a new bid for SPACs post merger as the risk-reward may be skewing to the long side. $BLDE, $OWL and $SOFI are examples of the deals that closed recently and have outperformed since. It is a good thing as June is bountiful in terms of how many merger votes are scheduled to happen. 25 to be exact! Here are the ones for next week:

I’m actually surprised at how high $SSPK already is (pun intended). $ACTC was always the high flyer. I remember $VGAC was trading at $17 even before there was a deal announced. $ARYA and $CAPA are both merging with a protein-sequencing biotech company, who are each other's direct competitors. That’ll be interesting to see how fast the two horses run once they’re out of the stable.

I remain in quarantine, and since I can’t venture out, my screen time on Tiktok has been up...significantly. But it's on Tiktok that I found this amazing peach, burrata and prosciutto salad recipe and I had it with this phenomenal Chardonnay!

That’s all for now. Hope your week ahead is just as peachy :)

-Nikita

If Ackman’s manoeuvre survives SEC scrutiny, it could be a template for other SPACs nearing the end of their 2-yr period to give themselves an out by spawning off a SPAC with a decent chunk of money but no timeline and a SPARC with no money OR timeline.

Salad looks and sounds wonderful and the Louis Jadot Pouilly Fuisse has been a fave of mine for years.